I was introduced to AUTO late last year and recently got around to taking a look at this business. I was attracted to it primarily because this is a lead gen business which has many of the same qualities as SaaS businesses on their rev gen side (marketing metrics/conversion rates). AUTO acquire website traffic via their portfolio of sites, convert this traffic into leads, and sells it to local dealerships. A capital light business that have some similarities to SaaS and tech businesses we’re normally invested in. Ultimately I decided against taking any positions, but I thought I’d share my quick analysis of AUTO with those who are interested. Feedback is welcome if I missed anything as I may take another look at it in the future.

AUTO is a lead gen business that owns a portfolio of automobile related websites, namely: autobytel.com, car.com, usedcars.com, and usedtrucks.com.

This is a an asset and capex light business in that they generate traffic from different sources (which I’ll cover briefly below), convert these traffic into leads of customers who are interested in used cars, and then sell these leads to local dealerships who has the inventory of the cars customers want. In a general sense, AUTO’s business makes sense and provides value for both their partners (car buyers and car sellers).

I’ll spare everyone the history of the business, but the short version is the old management team was shown the door due to poor management and declining revenues. New CEO was brought in and brought in his own executive team in 2019.

When the old guards leave and new ones come into a declining business, investors want to see the following:

- Transparency, and honesty on how the business is actually performing (PAR’s new CEO is a great example of how a new CEO should act)

- A plan to get the business back on track

- Signs that the business is stabilizing

Unfortunately I would rate management’s #1 & #2 as a 5/10 at best, and as for #3, there’s been no signs the business decline is stabilizing.

#1 & #2: After joining, the new management’s plan is essentially optimizing on revenue per lead as opposed to driving new leads. This is very disappointing as it shows management has no plan to solve the root cause of their problem to begin with, which was the decline in traffic (i.e., revenue).

I’m equally disappointed in the constant frugality talk instead of solving their root problem. “What you’ll find is that we are doing more with what we have” (19Q3 CC)

Most of the company’s trouble have to do with a decline in traffic and unfortunate timing in the slowdown of the US auto market. AUTO lost many of their paying car dealerships in the last 2 years in the market wide slowdown. However this is conflicting, as when car sales drop, you would think car dealerships would be more inclined to buy qualifying leads.

This leads me to believe car dealerships do not find AUTO’s leads meaningful in providing a ROI, and dealerships are cutting cost around ineffective marketing (AUTO’s leads) and increasing spend elsewhere (Google Ads). Indeed, management have also signaled in conference calls that they have been revamping their internal tracking systems to better show ROI for dealerships. I believe until this problem is solved and dealerships are persuaded that they should be spending their marketing dollars with AUTO, AUTO will continue to experience difficulties keeping old clients and signing new ones.

#2 and #3: As mentioned earlier, I was initially attracted to AUTO’s business model frankly because the same rev gen models that are used to calculate conversion rates from SaaS or growth tech companies can also be used with AUTO. At it’s root, AUTO can sell more leads if it can generate more leads, and if it can generate more leads if it gets more traffic. However the decline of their traffic have resulted in a decline in revenue, and new management is currently optimizing this remaining traffic instead of growing their traffic base.

While optimizing their conversion rates is a understandable thing to do, you’ll never grow if you’re forced to make more with the same amount. You don’t get rich by trying to make the most of a minimum wage job, you get rich by making more money (while also optimizing your monthly spend).

It’s admirable that the new management is looking to stabilize the business by increasing conversion rates and optimizing lead revenue, but this doesn’t fundamentally change their situation until they can find a way to renew their lost traffic. The current optimization plans will at best get them to a rough breakeven point. Their current market cap is 30M, with a 1.1M balance sheet while losing 2M per quarter. While they can likely bring in some AR, this will likely only buy them a longer runway until they can solve the real problem.

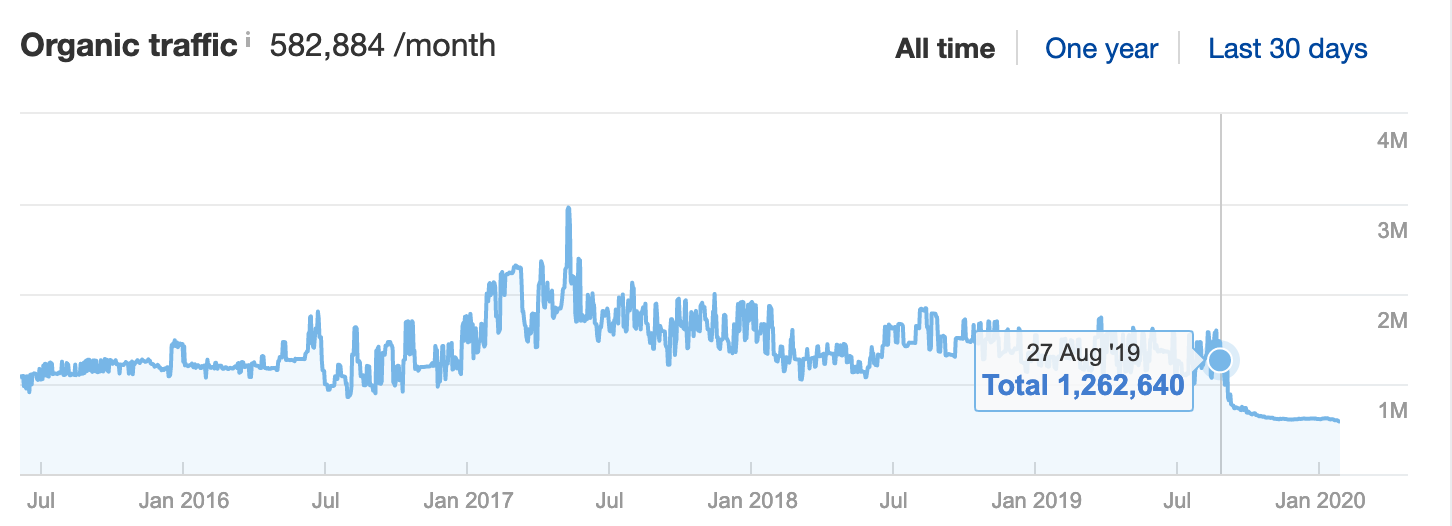

Importantly, we noticed AUTO’s primary website Autobytel.com’s traffic halved in late August 2019, dropping from an average of 1.2M visitors per month, to 600k per month:

With Q4 2019 earnings coming up, AUTO will likely be reporting more bad news before any good ones come in.

For now, I’ll be waiting on the sidelines until they can prove they have a plan to increase traffic and revenue, show stabilization in quarterly losses, and importantly show some honesty in their performance metrics.

To receive more ideas like this, subscribe to our mailing list: