Hi folks,

I wanted to do a very quick review of SMSI as it’s share price have dropped meaningfully since my last write-up with no fundamental change for it’s business, and I believe it now offers an extremely attractive price for a growing software business.

I covered SMSI in a recent blog post prior to their Q2 earnings. At the time SMSI was trading at $3.20/share (May 25, 2019). Shortly after Q2, their stock doubled on strong earnings report but have since pulled back after Q3’s earning report on no great reasons. I believe this is a once in a blue moon opportunity to buy into a robust recurring revenue generator growing at FAANG speeds (40%/yr) while at an extremely attractive price.

This will be a quick update note as a couple things have changed in favor of investors over the last few months.

A brief Intro of SMSI:

SMSI has 3 primary products (apps):

SafePath: an app that comes in 3 different set of functionalities. SafePath

Family is a set of features that allow it to control, connect and track other

phones with the app installed, primarily marketed as a family safety app, very

similar to Apple’s “Where’s my phone” app, but with more features which I won’t

cover here. The second and 3rd set of functionalities (SafePath IoT

& SafePath Home) allows this app to control and connect to other devices

like trackers, smart watches, security cams, etc. If you’ve used the Google

Home app, SafePath works in a similar way (although with a different UX and more

features). Between SafePath Family, Home, and IoT (all 1 app, just marketed as

3 separate feature sets) SMSI positions this app as a single device management

app that allows users to connect and control smart devices they have around

them (phones, trackers, cameras, TVs, etc). SMSI sells this app via partnerships

with major MSO and carriers, who then resells this app as a rebranded white-label

product to their own phone subscribers. I.e., SMSI partners with Sprint, who

then sells this app to Sprint’s customers. Sprint charges 7/month, they split

the revenue.

Commsuite: a voice to text app, but with more features but again I won’t cover those here, basically work similarly to Google Voice. Also sold via carrier & MSO partnerships to these carrier’s end customers, just like SafePath. Both Commsuite and SafePath obtains MRR as they’re subscription services like Netflix.

ViewSpot: a new app SMSI acquired last year. It allows you to configure a phone to only show specific content (a sandbox). If you’ve ever had the unfortunate experience of turning on your Windows laptop in “safe mode”, this is similar to it. This app is sold to retailers and carriers and used by these retailers and carriers as a sales agent. Carriers install this sandbox app on their display phones and tablets with pre-configured content (like the display phone’s key features, pricing, etc) primarily to help sell the display phone. SMSI receives recurring subscription revenue from their carrier customers based on the number of stores with this app installed. SMSI also receives additional ‘campaign’ revenue whenever carriers launch a new phone (i.e., IPhone 11) in their stores (think of ‘campaign’ revenue as a form of professional services).

This is a brief overview and I would encourage those interested in SMSI to understand their products in more detail. The short version is SMSI is application developer (industry: pre-packaged software) that sells it’s products to carriers to form marketing channels, these carrier partners then help them market and sell these products and they split the revenue. SMSI’s products are white-labeled for the carrier and acts as a revenue center for the carriers, while SMSI focuses on updating and building out the feature set of these products.

As I mentioned this is meant to be a quick update so I’ll skip to the more relevant things. SMSI had a blow out quarter In Q2 of 2019, finally turning massively profitable as I had anticipated and the share price doubled in the subsequent weeks.

After Q3 however, SMSI’s prices dropped by 40%. Nothing fundamentally changed for the company, but I believe this selloff was primarily due to the pending merger between Sprint and T-Mobile (more on this below). The TMUS & S merger has been in the works over the last 2 years so this shouldn’t be news, but given the state attorney’s trials it’s understandable that investors view this as a risk factor.

Sprint & T-Mobile Merger

This story impacts SMSI primarily because Sprint accounts for 77% of SMSI’s revenues, and following the “merger” (acquisition) T-Mobile will become the operating entity. If this looks worrisome, don’t be, much like my late grandmother’s pies, it looks much worse than it actually is.

Around the summer of 2018 SMSI’s management team begun guiding towards a pending Tier 1 carrier signing. At the same time, T-Mobile and Sprint announced their merger plans. SMSI’s management continued to guide toward this T1 carrier partner in the subsequent quarterly conference calls. It was widely expected that the T1 carrier would be T-Mobile. Our channel checks had also confirmed this would be the case.

However in Q3 2019 (prior to the stock price drop), SMSI’s management weakened their guidance to:

“It remains true that there is always risk with M&A activities, due to a variety of unknowns and things out of our control. However, we also see an equally great opportunity for growth and expansion of our business case as well.“

This was weakened from the previously guided T1 pending customer. The stock dropped in the following 3 months, worsened by end of year tax loss harvesting. I believe this drop is overblown. The weakening of SMSI’s guidance was immediately following the same time frame as the 2019 State attorney general lawsuit to block the TMUS & Sprint merger.

I believe while they’ve had to tone down their guidance on conference calls publicly, nothing fundamentally changed and they are still ramping up in anticipation of the T-Mobile signing. In fact, SMSI’s management has been on a significant hiring ramp the entire year, increasing their headcount from ~160 to ~200 as of Dec 2019. Actions speak louder than public guidance.

Separately, SMSI’s management have said that nothing have changed in regards to the T1 signing and their teams have been working with the merger teams at T-Mobile and Sprint directly. You can’t ask for much more ‘color’ than that.

Operating Model

The Q3 selloff is overblown and the subsequent tax loss harvesting have worsened the share price decline. I believe this is a once in a blue moon opportunity to buy extremely cheap shares of SMSI ahead of the upcoming TMUS and S merger trial conclusion. Numerous channel checks at TMUS and Sprint’s other vendors have point to a Feb – March timeline on new deal signings following the Jan 15 trial conclusion date.

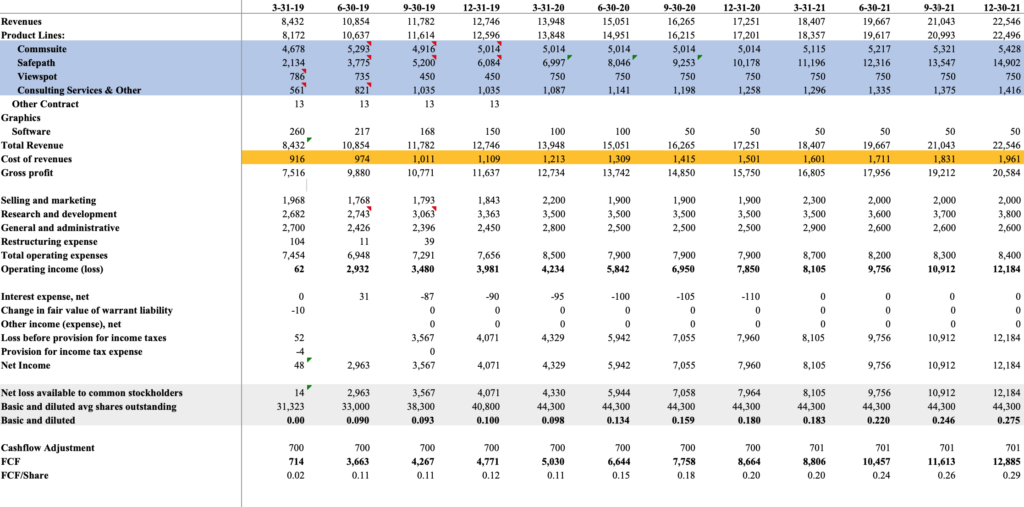

SMSI is a 150M market cap business with 24M in cash, generating 5M and growing per quarter with no debt. We’re basically buying the business for 125M that generated 11M in cash this year and will generate 25M in 2020 and 41M in 2021. 2020 and 2021 earnings based on CFO guidance and assumes zero new carrier wins (not pricing in T-Mobile).

My updated model for SMSI reflects the guidance CFO Tim Huffmyer provided, which was recently reaffirmed:

Valuation

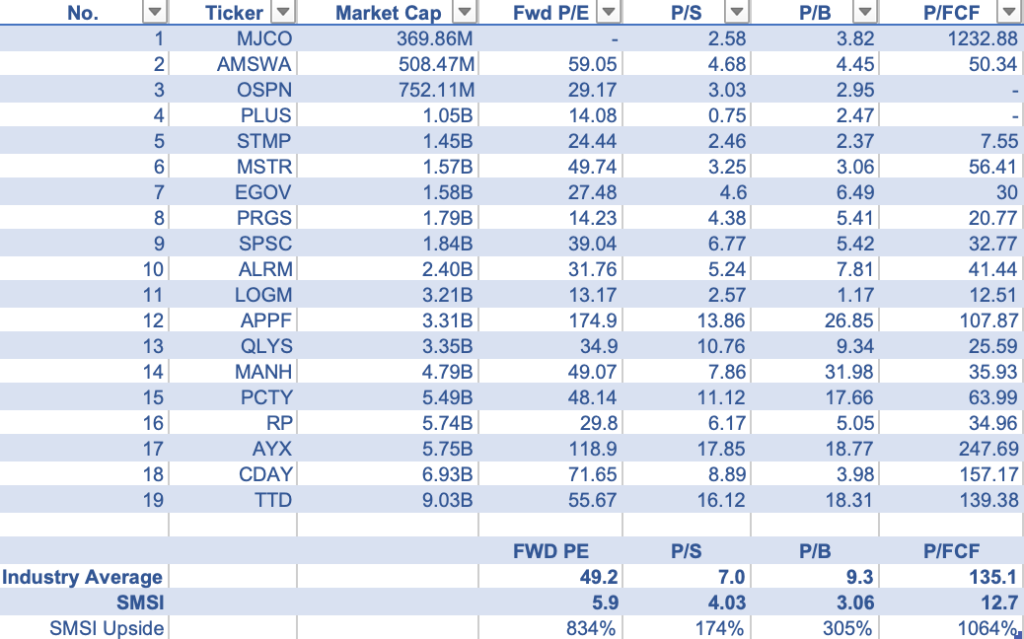

I think SMSI is cheap on a FCF basis (2020 P/FCF of under 6), but some prefers to relative valuations, here is SMSI against its industry peers:

Conclusion

I believe the recent selloff is due to the softening of TMUS & Sprint merger guidance management provided on Q3, worsened by end of year tax loss harvesting. However, management actions and channel checks reaffirm T1 signing by early next year. SMSI is extremely cheap even assuming no T1 signing with TMUS. With the likely Russell 2000 inclusion, and T1 signing in early to mid 2020, SMSI shares will likely be a multi bagger in within 12 months.

Disclosure: I own shares of SMSI and call options. Published as of Dec 27, 2019.

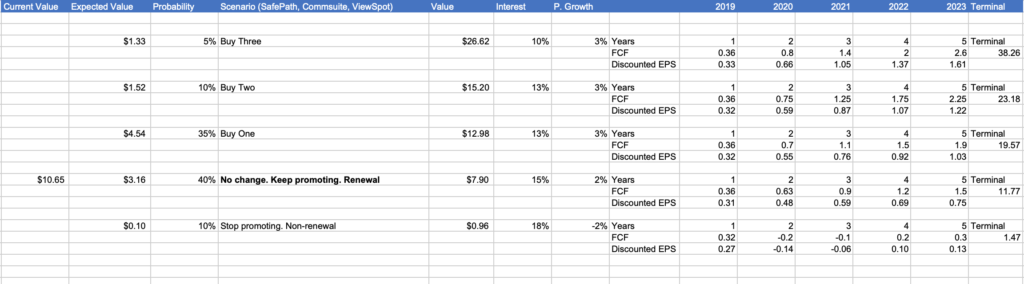

Edit: Valuation depending on different scenarios